How Are Carbon Credits Priced & Sold?

Content has been adapted from The Context Network “Get Smart, Stay Smart” Ag Carbon Service.

The short answer: Carbon credits in voluntary carbon markets are typically priced and sold by the market providers themselves. Like other consumer goods, prices for credits are influenced by supply and demand. As demand increases, so too could the average price paid per credit sold on the marketplace.

Back it up: What is a carbon credit?

- A marketable instrument

- Produced by a third-party verified project

- Representing one metric tonne of carbon dioxide-equivalent reduced or sequestered.

And who sells them? Markets do!

But there’s one thing to remember: carbon markets and carbon programs are not the same. Here’s the difference according to Context:

- Carbon markets serve as “the markets in which a supply of carbon credits is sold to companies that use them to meet their voluntary or regulatory GHG (greenhouse gas) emission goals or requirements.”

- A carbon program is the “comprehensive and recurrent service that aggregates farmers to generate and sell carbon credits from their farms.”

Like your local grocery store, a carbon market serves as the virtual location in which consumers can buy a product (carbon credits) from a manufacturer (land managers participating in carbon programs) without going to the manufacturer directly. And like a grocery store, a carbon market may take steps to ensure that their carbon credits are of sufficient quality to stock the shelves.

Markets rely on verifiers and registries to ensure carbon credits meet certain quality standards. The short version is this: a third party—not the producer or the market—steps in to verify that the proper steps were taken to sequester carbon or reduce carbon, thus producing a carbon credit. This credit is added to a registry.

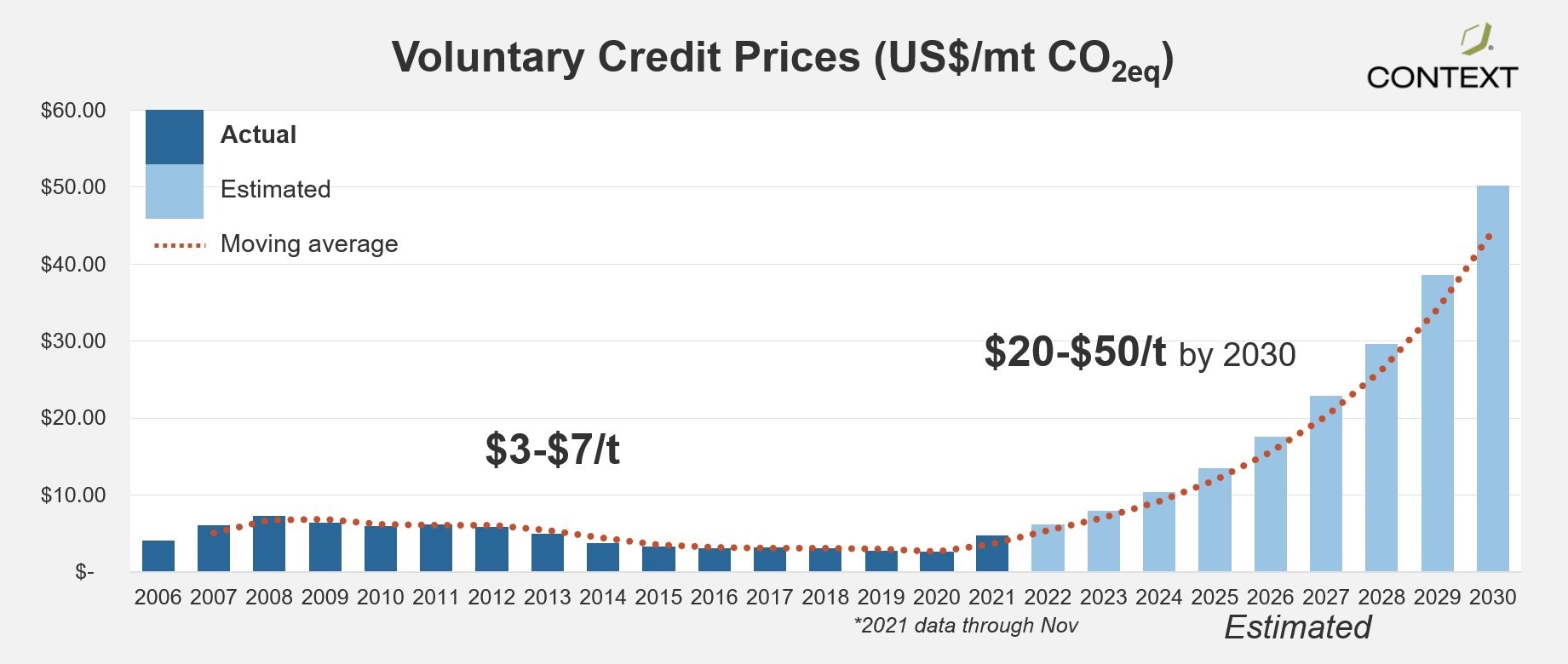

The value of a carbon credit fluctuates with supply, demand, and quality, just like other consumer goods. In a global average of voluntary carbon markets, the global average price of a single carbon credit has hovered between US$3-$7 since 2006. But of the 16 programs Context has reviewed, the average current published price of carbon credit in June 2022 was between $12-$15 per tonne.

But demand for carbon credits is changing. More and more companies and governments have set goals to reach net-zero greenhouse gas emissions. In fact, the U.S. government has pledged to reach net-zero emissions from all federal operations by 2050.

Here are some factors pointing toward projected carbon credit price increases:

- The average price of carbon credits increased in 2021.

- The Biden Administration released a report valuing the “interim social cost of carbon” at $51 per metric ton of CO2.

- Demand for carbon credits is expected to increase in the next decade as companies strive to meet sustainability goals.

Meanwhile, supply is ramping up. As demand increases, markets are springing up around the country to meet it, drawn by rising prices. Since U.S. carbon markets are voluntary, not regulatory, in 49 states, the systems for measuring sequestered carbon, setting up contracts, and providing payments to growers are as varied as the markets themselves.

The big picture: the experts at Context predict an increase in carbon credit prices in voluntary markets. Of course, there’s no way of knowing that for sure until we see it.

Photo by Edwin Remsberg and USDA-SARE.