What Are the Differences Between Voluntary & Compliance Markets?

Content adapted from The Context Network “Get Smart, Stay Smart” Ag Carbon Service.

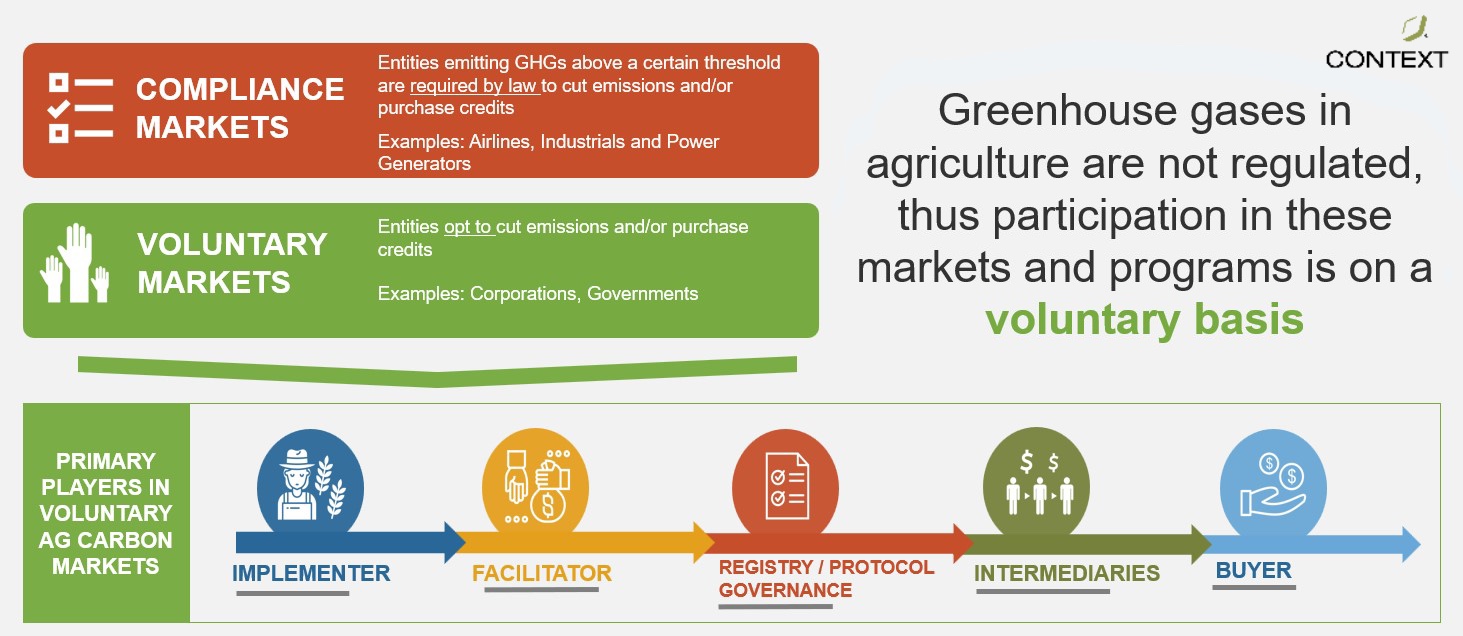

The short answer: Participants in compliance markets are mandated to decrease emissions or purchase credits by law, while voluntary markets serve those who opt in to cut emissions or purchase credits.

The big picture: In the U.S., there are no federally mandated, compliance-based markets for agricultural emissions. California is the only state with a compliance market, set up under a cap-and-trade scheme.

- Compliance markets serve entities who are legally required to cut emissions or purchase credits to buy offsets. These markets serve a regulatory function—they’re part of larger-scale plans to help reduce or offset generated greenhouse gas emissions.

- Participants include organizations like airlines, industry, and power generators that must meet national or regional mandates for greenhouse gas emissions.

- Because they are mandated, compliance markets sell credits at set rates, just like other commodities. Most regulatory markets follow mechanisms in the Kyoto Protocol.

- Voluntary markets are a bit different. Entities participating in voluntary markets are opting in, searching for ways to either decrease their own emissions and sell generated credits, purchase offsets from those who have generated carbon credits, or reduce emissions within their supply chains.

- Because they are not federally mandated—or regulated—many voluntary markets follow different schemes for measuring, reporting, verifying carbon sequestration, and setting prices for generated carbon credits.

- The “wild West” of voluntary markets is in flux. Voluntary market creators are trying to figure out the best way to collect data, pay farmers and land managers for credits, and provide verified and trustworthy credits to buyers.

Break it down: Since agricultural greenhouse gases are not regulated through compliance markets, players in agricultural carbon markets can work with carbon programs or facilitators to sell credits.

- The implementer is the farmer or land manager—the person on the ground, making decisions and practice changes to sequester carbon through agricultural activity.

- Facilitators are those running the program in which the implementer participates.

- Registry/ Protocol Governance are the set practices and terms with which an implementer must comply in order to participate in a program and earn carbon credits. Rules are set by the approved protocols, created by registries. Each registry has their own governance and standards. Registries have attempted to bring order to the ag carbon space, but there is room still for them to standardize.

- Intermediaries are those who facilitate the verification, listing, and purchase of carbon credits.

- Buyers are those purchasing credits for sequestered carbon. This could be an organization seeking to offset emissions within their own vertically integrated supply chain (i.e. General Mills working with its grain suppliers to decrease emissions and sequester carbon). Or it could be an organization, like Microsoft, purchasing offsets to remove an equivalent amount of carbon to “offset” their greenhouse gas emissions.

In short, voluntary markets face the challenges inherent in a free market system. Because there is no single regulatory body, it is up to the players in the voluntary ag carbon markets to settle on the best practices.

Photo by Lance Cheung and courtesy of USDA.